Start Your Dream

Specialized accounting and tax advice for foreigners. Protect your assets and ensure full IRS compliance

STRATEGIC DIFFERENTIALS

Bilingual Expertise

We understand IRS bureaucracy and speak your language. Specialized service in Portuguese, English and Spanish.

Licensed Federal Representative

We are a U.S. Treasury-licensed firm with the authority to represent 100% clients before the IRS in debt and tax defense matters.

Asset Protection

Preventive action against IRS risks and fines of up to $25,000 for simple technical errors or omissions.

Full-service solutions

A single strategic partner for your entire journey: from obtaining your ITIN to opening your business and returning your FIRPTA.

Security and confidentiality

High-tech document management through our Client Portal, with a secure and encrypted 100% environment.

CR Accounting & Consulting

About Us

Learn about all the services that CR Accounting & Consulting can do for you.

CR Accounting & Consulting advises those who wish to open their company in the USA, making it possible to do business of value between any country in the world in America.

Learn about our main services

We have a wide variety of services for individuals and companies.

We structure your business in the world's largest economy in an uncomplicated way. We carry out state and federal registration in up to 7 days (depending on the state), delivering your company ready to operate.

Far beyond compliance, Bookkeeping is a management tool. We deliver monthly financial reports so that you can follow the evolution of the business and make decisions based on real data, in line with local legislation.

The PJ declaration requires advanced knowledge of federal and state regulations. Avoid fines of $25,000 imposed by the IRS for technical errors. Our experts have extensive experience in international accounting.

We maximize your tax credits every year, ensuring that you take advantage of all the benefits offered by the US government. In addition, we offer specialized advice for those with assets abroad, enabling them to declare correctly and avoid IRS fines of up to $25,000.

Clear, didactic answers to everyday questions. From choosing the best corporate structure to complex withholding issues and international treaties, our consultants are ready to guide your financial life.

The ITIN (Individual Taxpayer Identification Number) is the essential tax identification for those who are not eligible for Social Security. We carry out the complete application process with the IRS, allowing you to file your taxes, open bank accounts and invest legally.

We manage your team's payroll, issuing reports, calculating labor taxes and ensuring that all monthly and annual payroll obligations are strictly complied with.

Each state has its own Sales Tax rules. We help with the application, collection and reporting of the tax, as well as advising on exemption certificates for the purchase of products for resale.

When you sell a property in the USA as a foreigner, tax is withheld at source. We advise you on the rules and conduct the process to refund all or part of the amount withheld by the IRS.

We offer customized lectures for seminars, business conventions and universities. We translate the complexity of the American system to your organization with a focus on tax education and international business.

invest in the united states

The World's Largest Economy

Our Clients

Testimonials

"CR Accounting has been doing my taxes for over 2 years now and I definitely recommend them to everyone, they are really responsible and ready to answer any questions you have. Claudemir is amazing and has become someone I trust with my eyes closed. Five stars without a doubt."

Daniele Anselmo

"I have nothing but praise and immense gratitude for CR Accounting & Consulting!

I am Brazilian and have a company in the USA, and for about 1 year they have been assisting us with all the accounting for our LLC.

I strongly trust and recommend the work of CR Accounting & Consulting!"

Marcela Marques Luciano

"Very honest staff. They opened my company quickly and answered all my questions. In the monthly follow-up they are very prompt in answering all questions."

Rafael Peregrina

"I recommend CR Accounting & Consulting and the whole team because they have been doing my income tax and taking care of my company for a few years now, always providing excellent service, very seriously and with a vast knowledge, in short 5 stars in everything."

Marcio A de Souza Silva

Our Clients

Testimonials

EXCELENTETrustindex verifica se a fonte original da avaliação é Google. Empresa super de confiança! Eles resolveram todas minhas questões tributárias nos Estados Unidos. São muito competentes e super profissionais. Pode esperar o melhor deles! O atendimento eh excelente, o trabalho eh mto eficiente. Indico a todos os brasileiros que estão nos EUA. Já estou com eles a 2 anos e me ajudaram muito 🙏Publicado emTrustindex verifica se a fonte original da avaliação é Google. Atendimento EXCELENTE! Me ajudaram com tudo, passo a passo, quando fui fazer meus impostos. Todos atenciosos e gentis! Respondem super rápido também.Publicado emTrustindex verifica se a fonte original da avaliação é Google. Excelente atendimento. Rápido, fácil e descomplicado. Equipe muito profissional. Recomendo.Publicado emTrustindex verifica se a fonte original da avaliação é Google. Excellent work!Publicado emTrustindex verifica se a fonte original da avaliação é Google. Excelente!! Atendimento rápido e eficiente. Todos muito profissionais, gentis e super prestativos. Fizeram meu imposto de renda rapidamente, sem nenhum problema! Agradeço muito a ajuda!Publicado emTrustindex verifica se a fonte original da avaliação é Google. I was helped by Mr Claudemir at CR Accounting & Consulting, he was very patient with me and explained the process with lots of details. And he started and finished my case in two days!!!! I trust CR Accounting and Mr Claudemir's work completely!!!! He is now my oficial accountant!!!!Publicado emTrustindex verifica se a fonte original da avaliação é Google. Empresa muito atenciosa e responsavel com os seus clientes. Em especial o Claudemir, o qual, sempre disponivel e rapido para as respostas das minhas duvidas referentes ao meu imposto. 5 estrelas para essa empresa.Publicado emTrustindex verifica se a fonte original da avaliação é Google. Best ever we have our business and personal They are simply greatPublicado emTrustindex verifica se a fonte original da avaliação é Google. Gostei muito do atendimento, fui atendida pelo Claudemir muito profissional, paciente, gentil e entende muito de contabilidade, fiz meu IMPOSTO DE RENDA NOS EUA, com ele!! Super indico!! 👏👏Publicado emTrustindex verifica se a fonte original da avaliação é Google. A good accountant is like a good doctor: once you find the right one, you keep it for life. The team at CR Accounting is like that. I've been with then since my initial 2018 tax filings and always received the highest levels of service. Highly recommend it.

Follow our articles

Blog

Definitive departure from Brazil: Understand the new tax system, the risks of not declaring and when it is really worth formalizing your departure

In recent months, the topic of permanent departure from Brazil has returned to the center of discussion following a controversial statement by the federal government and the Internal Revenue Service.

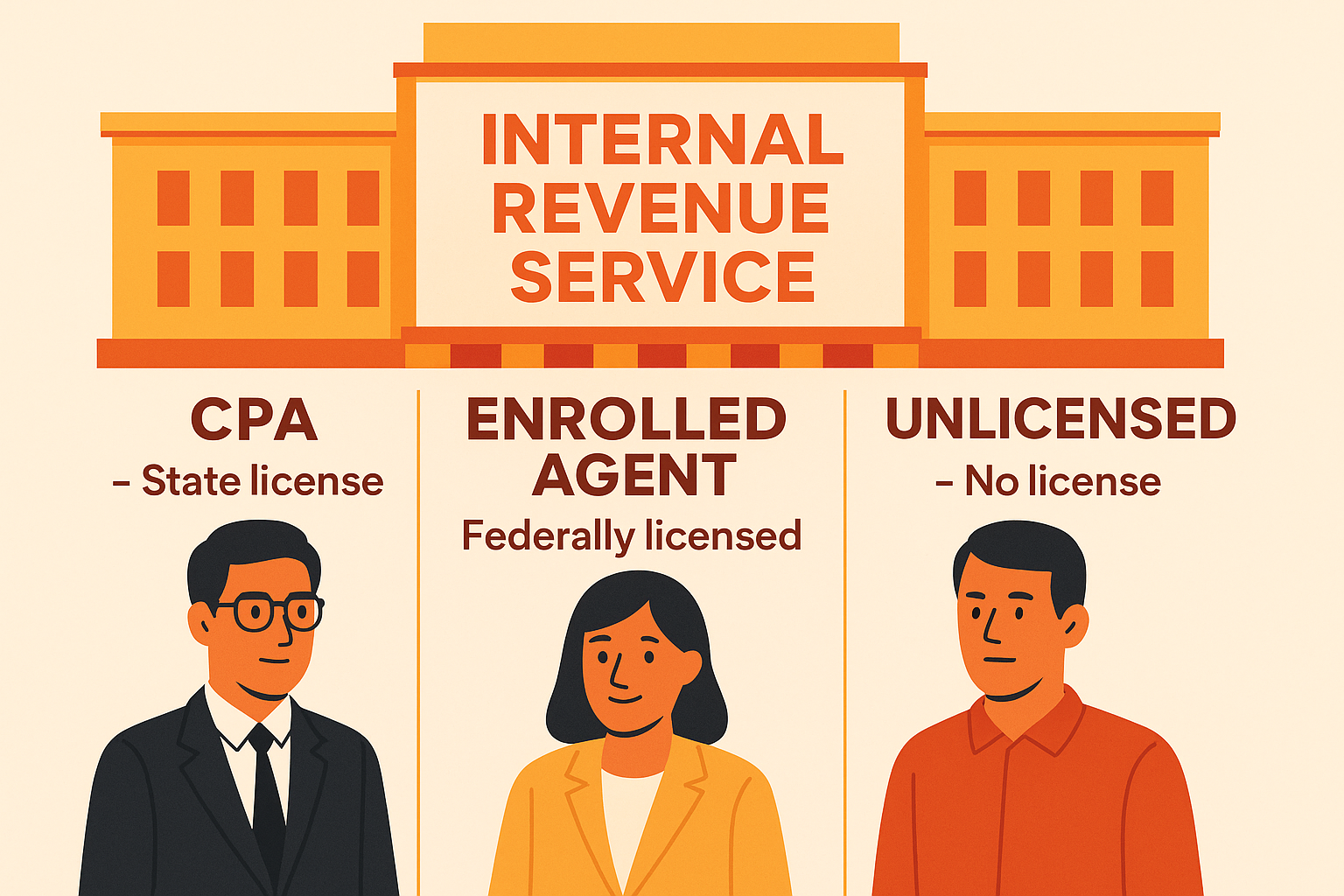

The Complexity of American Taxation and the Different Profiles of Professionals: CPA, Enrolled Agent and Unlicensed Preparers

The US tax system is renowned for its complexity, large volume of rules and constant updates. Every year, taxpayers have to interpret rules

One Big Beautiful Bill Act

Tax Impacts and Other Provisions US President Donald J. Trump signed into law on Friday, the 4th of July holiday.

Frequently Asked Questions

Our physical headquarters are strategically located in the financial heart of Miami: Brickell, FL. Although we have this solid base in the USA, we serve clients globally through a high-performance remote structure, guaranteeing support wherever you are.

The average opening time varies between 7, 15 and 30 days. This time depends on the US state chosen for registration and the IRS processing time for obtaining the EIN (the US CNPJ).

We carry out customized tax planning to avoid double taxation. Our focus is to ensure full compliance with the US Internal Revenue Service (IRS), reducing the tax burden so that the taxpayer pays the minimum tax within the law.

When you become a tax resident, you must declare your global income (Form 1040) and report financial assets abroad through FBAR, FATCA and other specific reports for income generated outside the USA.

Yes, the process is completely digital. We take care of everything online: from defining the best corporate structure (LLC or Corp) to federal registration and the necessary licenses.

We offer a full-service solution: Opening a company, Bookkeeping (monthly accounting), Income Tax, Regularization via Streamlined, FIRPTA Refund, ITIN Number application and strategic consulting.

The process is simple: just click on the “Schedule Expert Advice” button here on the website or contact us directly via WhatsApp. We offer flexible schedules to suit different time zones.

Totally. We prioritize the security of your data by using the Secure Customer Portal, a platform with state-of-the-art encryption that guarantees total confidentiality and absolute protection of your sensitive information.

We strictly monitor the American fiscal calendar. The main deadlines range from March 15 to April 15, and can be as late as October 15 in the case of extensions. Our proactive management ensures that you never pay late penalties.

Yes. Our team is bilingual and multicultural. We offer full support in Portuguese, English and Spanish, eliminating communication barriers for our international clients.

Talk to CR Accounting & Consulting

CONTACT