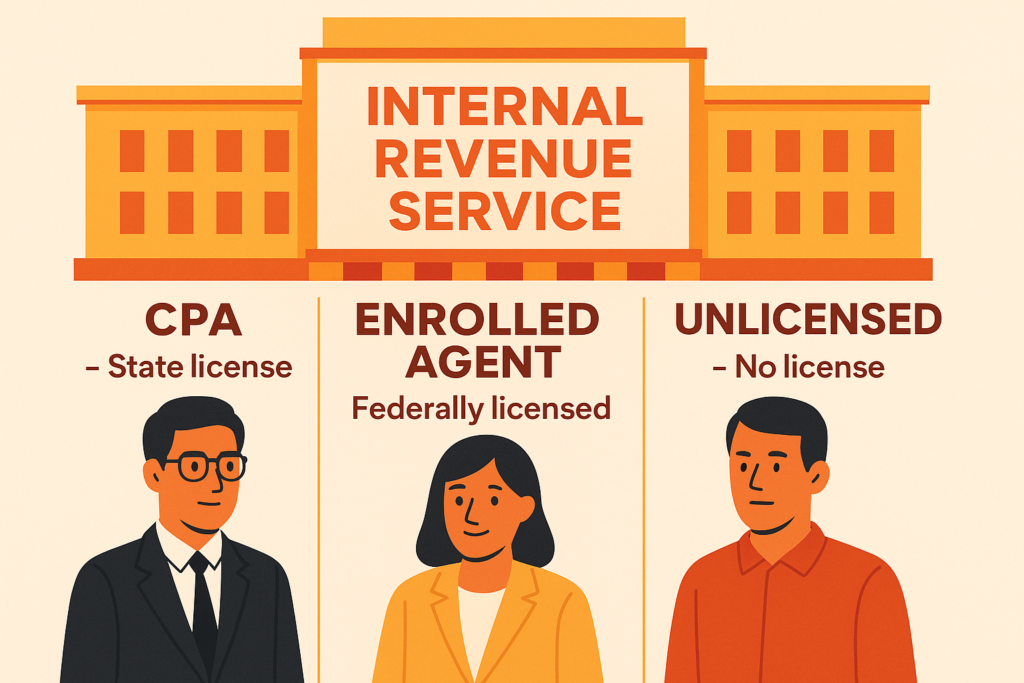

The Complexity of American Taxation and the Different Profiles of Professionals: CPA, Enrolled Agent and Unlicensed Preparers

The U.S. tax system is known for its complexity, large volume of rules, and constant updates. Each year, taxpayers must interpret federal, state, and, in many cases, local rules, in addition to dealing with a set of forms, credits, deductions, and ancillary obligations that vary according to economic activity and family structure. […]