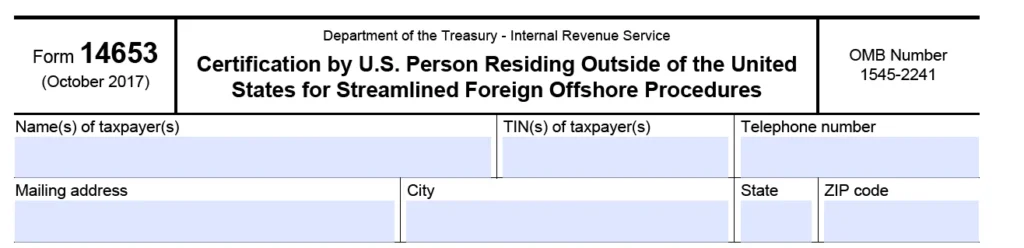

Definitive departure from Brazil: Understand the new tax system, the risks of not declaring and when it is really worth formalizing your departure

In recent months, the issue of definitive departure from Brazil has returned to the center of discussions after a controversial statement by the federal government and the Internal Revenue Service indicating a greater effort to identify Brazilians who have left the country but continue to be considered tax residents because they have not formalized their departure. However, the information was subsequently refuted […]