The US tax system is known for its complexity, large volume of rules and constant updates. Each year, taxpayers have to interpret federal, state and, in many cases, local rules, in addition to dealing with a set of forms, credits, deductions and ancillary obligations that vary according to economic activity and family structure. In this scenario, the role of tax professionals becomes essential.

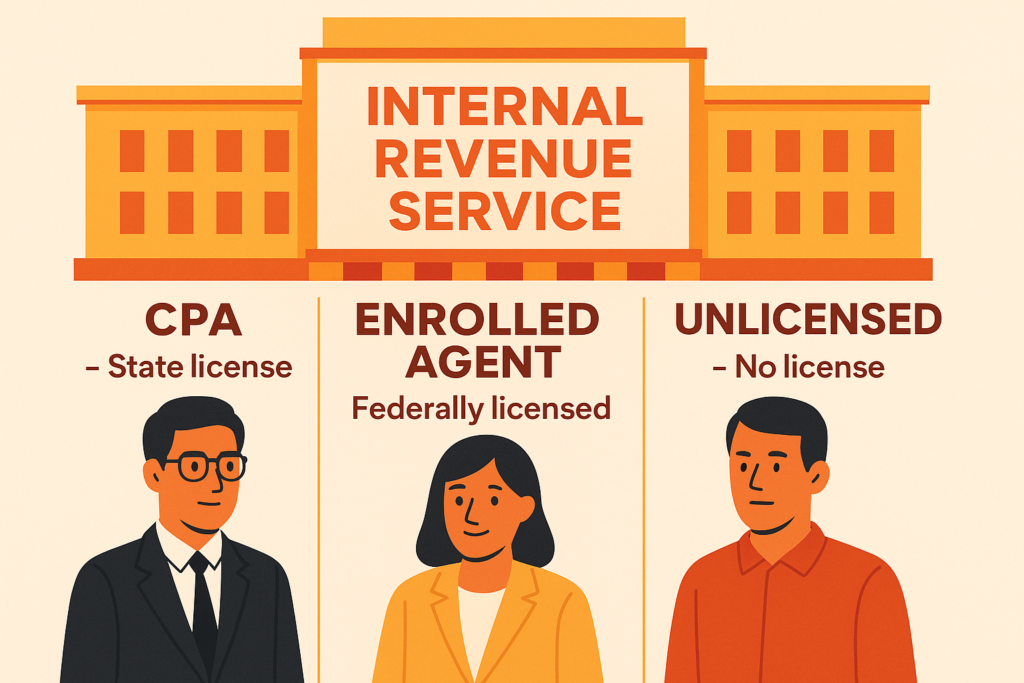

However, not all professionals have the same level of training, legal authority or scope of action. Among the main profiles found in the American market are CPA (Certified Public Accountant), o Enrolled Agent (EA) and the unlicensed trainers. Although everyone may be involved in tax preparation, their qualifications, responsibilities and limitations differ significantly.

Below, we explore these differences in depth, allowing the reader to understand the role of each category within the US tax structure.

CPAs - Professional Accountants with State Licenses

A CPA is a licensed professional at the state level. To obtain this license, the candidate passes a rigorous accounting and auditing exam, in addition to fulfilling academic and practical requirements. The CPA is widely recognized for his solid training in:

- Financial accounting

- Auditing

- Corporate reports

- Business consulting

- Tax planning (when specialized)

Although many CPAs work in the tax field, this is not mandatory or exclusive. State licensing implies that your professional authorization is linked to the state where the license was issued. This means

- The CPA's work is subject to state jurisdiction.

- Each state defines its own rules for licensing, renewal and professional mobility.

- A CPA can serve clients in several states, but his license is always tied to his home state and the rules that regulate it.

Their comprehensive training often positions the CPA as a versatile professional, especially in corporate services that go beyond the tax sphere.

Enrolled Agents - Federal Tax Specialists

Among the professionals who work in the American tax world, there is a distinct category: the Enrolled Agent (EA). Unlike any other professional in the field, the EA does not receive his authorization from a state or a regional council - but directly from the US Treasury Department, through the IRS.

This characteristic gives Enrolled Agents a particularity that is unmatched on the market:

- Your license is federal

- Your authority is valid in all 50 American states

- Its performance is exclusively focused on taxation

To become an EA, the candidate must:

- Approve the Special Enrollment Examination, considered to be one of the most in-depth tax examinations in the country; or

- Proof of experience in the IRSin specific areas of fiscal activity.

In addition, Enrolled Agents are subject to strict annual continuing education requirements, always focused on tax regulations and updates. This is an important point: while other professions may require diverse training, the EA career is built entirely around federal tax laws.

Because they are regulated directly by the IRS, EAs have full authority to represent taxpayers in any interaction with the federal agency - from simple clarifications to complex administrative proceedings.

Unlicensed Professionals - A Segment Without Standardization and Supervision

Alongside licensed professionals, there is a large number of tax preparers who work without any formal certification. These individuals, often known simply as "tax preparers", have no formal certification:

- State license

- Qualifying exam

- Professional supervision

- Continuing education obligation

- Authority to represent the taxpayer before the IRS

Although some have good practical experience, the absence of regulatory standards creates a risky environment for taxpayers. The IRS even publicly expresses concern about mistakes made by unqualified preparers, such as:

- Incorrect application of tax credits

- Undue deductions

- Poorly completed declarations

- Audit risks

- Penalties and fines

The lack of formalized professional responsibility means that, faced with a tax problem, taxpayers can be completely helpless.

Comparing the Three Profiles Strategically

To better understand the difference between them, it's worth looking at the core elements that distinguish CPAs, EAs and non-licensed professionals:

1. Legal authority

- EA: national authority, federal license issued by the IRS.

- CPA: state authority, dependent on licensing status.

- Unlicensed: no formal regulatory authority.

2. Scope of action

- EA: federal taxation, representation and tax advice.

- CPA: accounting, auditing, consulting and taxation (depending on specialization).

- Unlicensed: tax preparation, with no representation and no guarantee of technical knowledge.

3. Supervision

- EA: direct supervision of the IRS.

- CPA: supervised by state accounting boards.

- Unlicensed: without professional supervision.

4. Geographical scope

- EA: can work in all American stateswithout restrictions.

- CPA: limited to the state of license (although it can serve customers from outside, its regulatory authority remains statewide).

- Unlicensed: without formal limits, but also without recognized authority.

The Relevance of Specialization in Taxation in the Current Scenario

With the constant changes in federal tax laws - from inflation adjustments to legislative reforms - the importance of professionals who dedicate their careers exclusively to taxation is growing. By dealing with issues such as:

- complex individual statements,

- business taxation,

- interstate operations,

- federal compliance,

- specific credits and deductions,

- IRS audits and correspondence,

the depth of knowledge and authority of the professional make a direct difference to the results.

At this point, the federal licensing model, focused solely on taxes, places Enrolled Agents in a unique position within the US tax structure. Targeted specialization, continuous updating requirements and federal authorization offer a level of technical alignment that is difficult to find in other categories.

Conclusion

The tax world in the United States is vast, technical and full of nuances. Knowing who the professionals are who work in this environment - and what their training, limitations and areas of specialization are - is essential for any taxpayer seeking security, compliance and clarity in complying with tax obligations.

While CPAs bring a comprehensive accounting background and unlicensed preparers represent the riskiest segment of the market, there is a category that distinguishes itself by being licensed directly by the body responsible for federal tax administration and for being allowed to act in the entire national territory. Understanding this structure helps taxpayers make more informed decisions in line with the challenges of the complex American tax system.

If you still have questions, talk to us. At CR Accounting & Consulting, our professionals are licensed to represent you before the IRS, from simple to complex issues