American citizens or green card holders living abroad often ignore the obligation to declare global income to the US, making them subject to severe penalties and criminal fines.

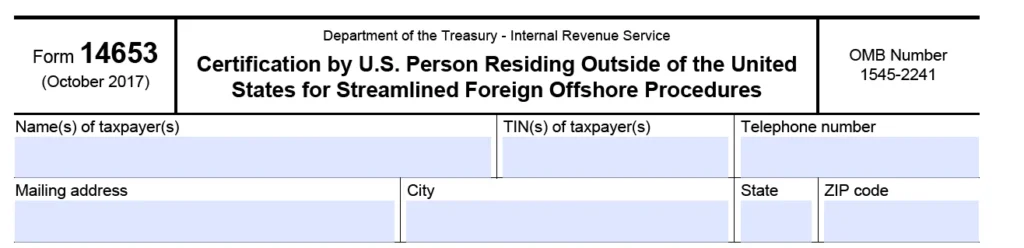

If you're in default because you don't know the IRS rules, the Streamlined Filing Compliance Procedures program is your legal way out. It allows you to settle the last 3 years of tax returns and 6 years of FBARs without incurring late payment penalties.

Our team of international tax experts certifies your eligibility and conducts the “amnesty” process, protecting your assets and clearing your record with the tax authorities once and for all.